Prof. Jagdish Shettigar (View Full Profile)

Area Head, Economics

Professor of Economics

Prof. Pooja Misra (View Full Profile)

Chairperson, PGDM (Retail Management)

Associate Professor of Economics

With the number of Covid 19 cases for India fast approaching 30,000 as on April 28, 2020 and the World Health Organisation (WHO) having declared the same as a pandemic it is imperative to understand the havoc that the flu epidemic can create on the Indian economy.

Tracing back history, the Spanish flu 1918 had hard hit the world and claimed 50 to 100 million lives globally with India suffering the highest casualty to an extent of 18 million lives. To minimize the mayhem that such a pandemic can wreak on the lives of people the Indian Government imposed a nationwide lockdown effective March 25, 2020.

As rightly said, “India chose to sacrifice its economy and save lives” – “जान हैं तो जहान हैं”. The downside of any Lockdown is that economic activity and businesses come to a standstill and the economy is abruptly halted in its growth track. Thus, with India currently being in Lockdown 2.0, it is important to understand the impact this has had on the Indian economy.

Slowdown of Economic Growth

Post the pandemic having struck, the International Monetary Fund (IMF) has revised the global growth estimate from 3.3% to a contraction of 3%. Developed countries such as United Sates of America, are forecasted to face a contraction of 5.2% (S & P Global, 2020). Moody’s Investors Service (Moody’s, 2020) revised its forecast for India to 2.5% from an estimated 5.3%. As stated by (Kaur, 2020), IMF in its World Economic Outlook has revised the growth numbers for India 2021 to 1.9% and Fitch to 2% from 5.1%.

World Bank has stated that India is likely to grow by 1.55% to 2.8% in 2020-21 due to disruption in demand and supply resulting in sharp growth deceleration in FY21.

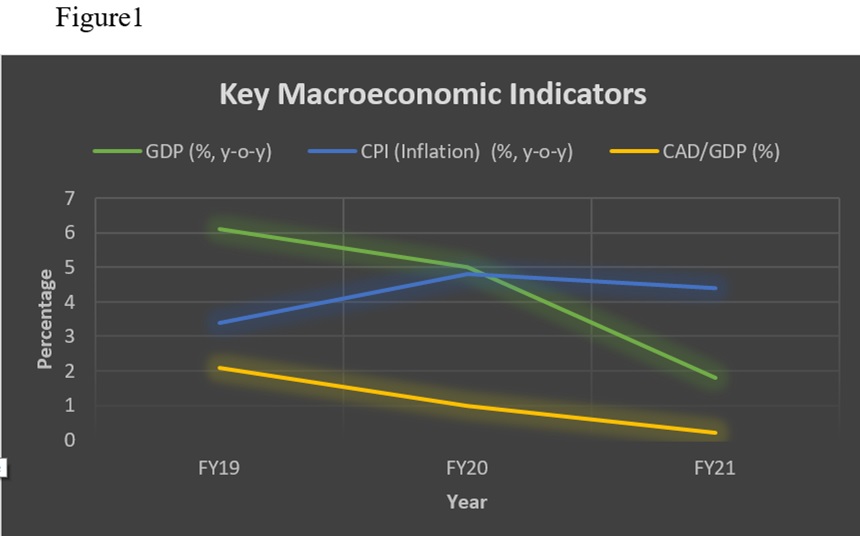

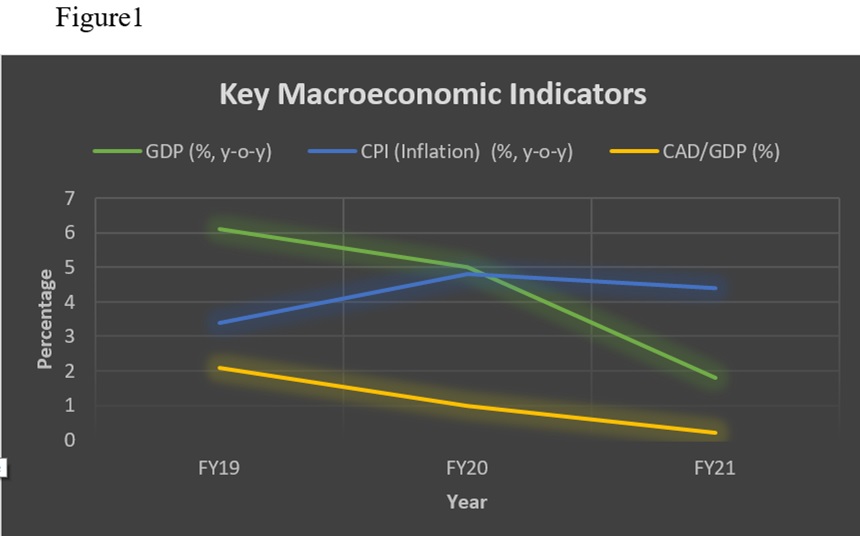

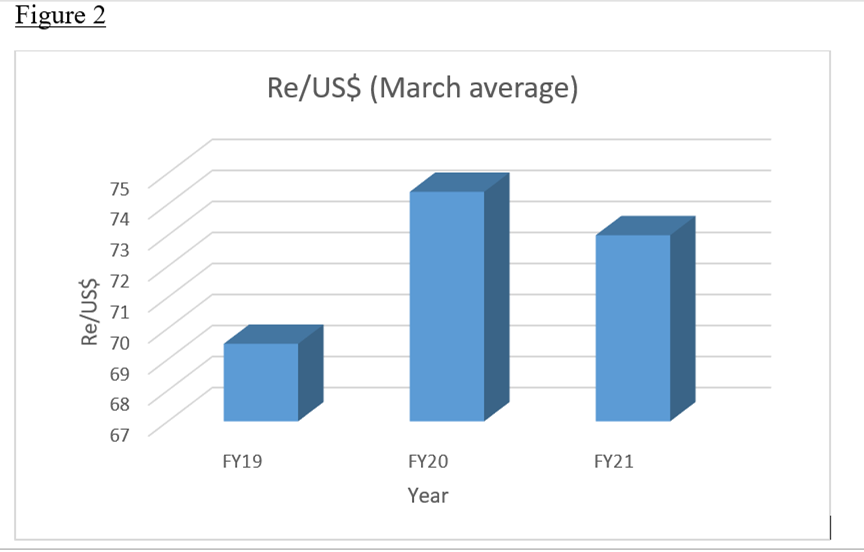

Figure 1 shows the impact of Covid19 on key macroeconomic indicators ie GDP y-o-y growth, CPI inflation and CAD/GDP (CRISIL, 2020). The decline in growth numbers are reflective of the aftermath of Covid19, CPI shows a softening of inflation numbers due to increase of food grain production. The sharp plunge in oil prices is expected to have a positive impact on CPI and CAD/GDP.

Source: National Statistical Office (NSO), Budget documents, Reserve Bank of India (RBI), CRISIL

The positive is that World Bank expects growth of Indian economy to rebound to 5% in fiscal 2022. Economists and researchers are forecasting anything from a best case scenario of ‘V’ shaped recovery curve to ‘U’ or ‘L’. A ‘V’ or ‘U’ shaped curve is correlated to the timing and magnitude of government stimulus and how companies and market structures are able to cope with a low level of demand. While Q1 has been negatively impacted due to the Lockdown, Q2 and Q3 are expected to be riddled with low consumption levels, falling business investment and declining exports adversely impacting the Indian economy.

Demand and Supply Constraints

On the demand side private consumption is likely to contract due to loss of income in the face of domestic outbreak and people preferring to conserve and hold on to cash amidst increased economic uncertainty. Thus spending will only be on essentials such as food and healthcare services. On the supply side, businesses are expected to cut back on capital expenditure and conserve cash for any unforeseen emergency in the near future.

To add to its woes, the pre-Covid 19 scenario of the Indian economy of liquidity shortage and credit availability issues in the financial sector of the economy has only worsened the situation. Existing inherent weaknesses in the financial sector of the Indian economy such as hampered flow of credit due to severe liquidity constraints in the banking and non-banking financial sector and existence of large NPAs will amplify the effect of a coronavirus induced shock.

To add fuel to the fire, the uncertainty has adversely impacted the Sensex / Nifty as investors have resorted to relentless selling bringing down the BSE sensex from over 40,000 to hovering around sub 32,000 as on date. This brings to light a paradox of FII money leaving the boundaries of the host country even though it offers a higher interest rate relative to the Fed rate.

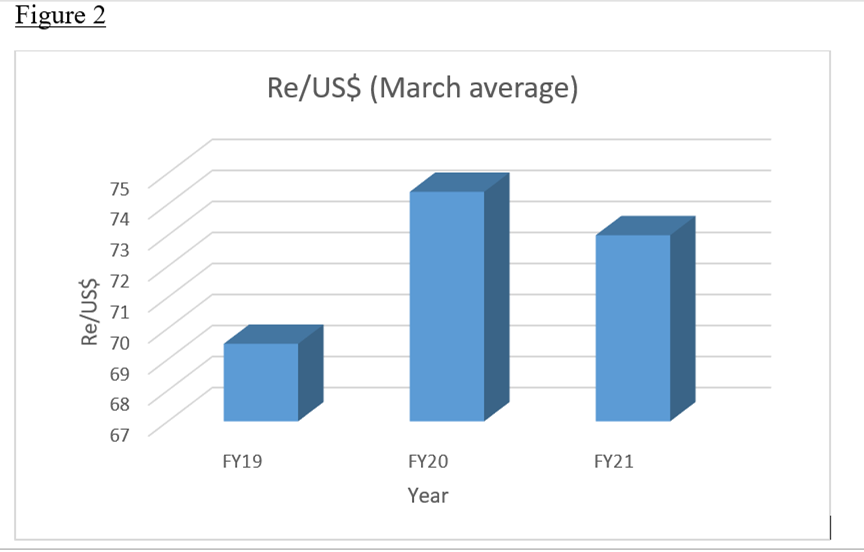

Another point of concern for emerging markets including India has been the massive sell-off in global risk assets by foreign portfolio investors due to Covid 19 pandemic thereby negatively impacting the domestic currency and making it volatile. INR has depreciated by approximately 7% since January 2020 and is around Rs. 76.73 to a dollar as on April 24, 2020, with average for month of March being Rs. 74.4 to a USD (Figure 2)

Source: National Statistical Office (NSO), Budget documents, Reserve Bank of India (RBI), CRISIL

Source: National Statistical Office (NSO), Budget documents, Reserve Bank of India (RBI), CRISIL

Sectoral Impact

Sectors such as aviation, hospitality, tourism and real estate are expected to feel the heat and bear the brunt of the pandemic. Large scale cancellations of travel bookings and hotel accommodation are expected to continue in the near future until a vaccine or cure is discovered. Declining footfalls in shopping malls and closing down of theatres has seen a negative impact on discretionary spending thereby having a boomerang effect on the retail sector.

As per Mr. Rakesh Biyani, Managing Director, Future Retail, operating costs of retailers will see a rise by upto 35% after implementing the new SOPs with reference to social distancing norms and a token system in stores. Rather, in-dining restaurants, cinema halls and shopping malls are expected to continue witnessing a downslide even post opening of the lockdown.

The expectation is that revival in real estate will happen primarily with demand for warehousing and distribution centres. Medium to high negative impact has been witnessed by sectors such as apparel and textiles. Power generation being an essential service is probably the only sector that has had a low impact. The flip side being with shut down of factories, how will the power sector manage the low energy demand?

With these sectors adversely impacted it will negatively influence the demand for the workforce leading to rise in unemployment numbers. On the supply side, with factories being shut and migrant laborers endeavoring to return to their villages, this will result in shortage of workforce and negatively influencing manufacturing, public transport services and construction.

Sectors such as automobile, electronics, chemical products, electrical machinery, leather products, mobile handsets and network equipment manufacturing etc. have been impacted big time. This could be primarily due to dependence on supply of intermediate goods from China. However, this effect seems to have been mitigated to a certain extent due to the common practice of Indian firms stockpiling inventory. FMCG sector is operating at scaled down levels due to shortage of manpower and lack of raw material. This coupled with social distancing norms being applicable even for manufacturing and factories will result in lower production levels, thus restraining the supply chain. To further add to the woes, 37% of the urban regular wage employees in urban India are informal sector workers who will face uncertain income due to stalling of economic activity (KPMG, 2020).

It is perceived that the negative impact would be higher due to the demand side rather than supply side for countries across the world. The low demand has also not spared the demand for crude oil. Low demand coupled with the price war between the global players ie Saudi Arabia, Russia and United States of America has largely led to a fall in price of crude oil, with price of Brent dropping to 19.34$ per barrel in April 2020 as against 32.01$ per barrel in March 2020. Benefit of falling oil prices which is a major advantage for the Indian economy as 80% of our requirement is met by imports has been retained by the Government to strengthen their fiscal position.

Silver Lining on the Wall

The upside of the situation is that sectors such as e-commerce and internet business for certain business verticals ie food, grocery, health/hygiene and online learning have seen an uptick. The ‘New Normal’ post this crisis will be one of structural changes in people’s lives. The pandemic has not only changed people’s lives, but also changed the geopolitical environment and brought a shift towards localization of the supply chain, given a push to digitalization with ‘work from home’ being the new norm and businesses working towards building agility in their business models.

The crisis seems to have shaken up the world economic order and India’s effort should be to maximize the opportunities presented by wooing MNCs that are looking to shift manufacturing activities out of China and simultaneously wanting to take advantage of cheap labor to contain their bottomline.

Government and RBI intervention for stability and fueling up the economy

Thus in such a scenario the main drivers to economic growth in the absence of private consumption and export led growth can only be increased Government spending and ensuring availability of credit in the financial system of the economy. The Government of India has announced a Rs. 1.7 crore relief package/ stimulus with the objective of helping those individuals hardest hit by the Lockdown. This package is focused mainly on cash transfer and food security measures by providing free cereals and cooking gas apart from direct cash transfers to the people at the bottom of the pyramid. Some of these measures being: food security additional 5 kg of wheat or rice and 1 kg of dal monthly for 3 months under the public distribution scheme, Rs. 2000/- to 87 million farmers under PM Kisan scheme, Free LPG under PM Ujjwala Yojana, Rs. 500/- per month to 200 million women for 3 months under the Jan Dhan Yojana to name a few.

Additionally, the Reserve Bank of India with a view to increasing liquidity in the financial sector to the tune of Rs. 3.74 lakh crore, slashed the repo rate by 75 basis points to 4.40%, reverse repo by 90 basis points to 4% (this was further slashed by 25 basis points on April 17, 2020), borrowers to be allowed a three month moratorium on payment of instalment of term loans, auction of targeted LTRO (long-term repo operations) of 3 year tenor for Rs. 1 lakh crore, reduction of CRR by 100 basis points, special liquidity facility of Rs. 50,000 crore for mutual funds to name some of the measures.

Interestingly, in order to be able to seize the opportunity that the adverse situation has provided, the Indian Government is simultaneously working on changing policies to emerge as an alternative attractive manufacturing destination and has set up dedicated groups to tap firms that are wanting to diversify out of China. Additionally by rising to the grave situation existing across the world and supplying hydroxychloroquine to countries, the Indian Government has once again managed to win over both its friends and foes.

BUT, the question now is are these measures adequate to provide the requisite boost to the economy? Keeping in mind lower GST revenue collection, would it be wise on the part of the Government to provide tax reliefs to fuel up demand? Should Government adopt the Keynesian theory of economic growth? Are there any lessons to be learnt from the Great Depression of 1930s?

Should it provide the stimulus to the economy in small doses (come out with an Industry specific stimuli……………) or announce a big bang stimuli are some of the questions that the Government and economists need to ponder upon and act fast.

This is the time for the Government and fellow Indians to reboot, redraw and reinvent the wheel of progress and paint a new standing in the World Economic Order.

References:

CRISIL. (2020, April 27). COVID19 Macroeconomic Impact. Retrieved April 28, 2020, from file:///D:/Macroeconomics/Covid19/CRISIL_Covid19_impact_FAQs_Apr27_2020_Sec.pdf

Moody’s. (2020, March). Global Macro Outlook 2020-21: Global growth will remain sluggish as large engines of economic activity slow. Retrieved April 23, 2020, from https://www.moodys.com/login?ReturnUrl=http%3a%2f%2fwww.moodys.com%2fviewresearchdoc.aspx%3fdocid%3dPBC_1161766%26lang%3den%26cy%3dglobal

#covid19 #India #Indianeconomy #RBI

Source: National Statistical Office (NSO), Budget documents, Reserve Bank of India (RBI), CRISIL

Source: National Statistical Office (NSO), Budget documents, Reserve Bank of India (RBI), CRISIL